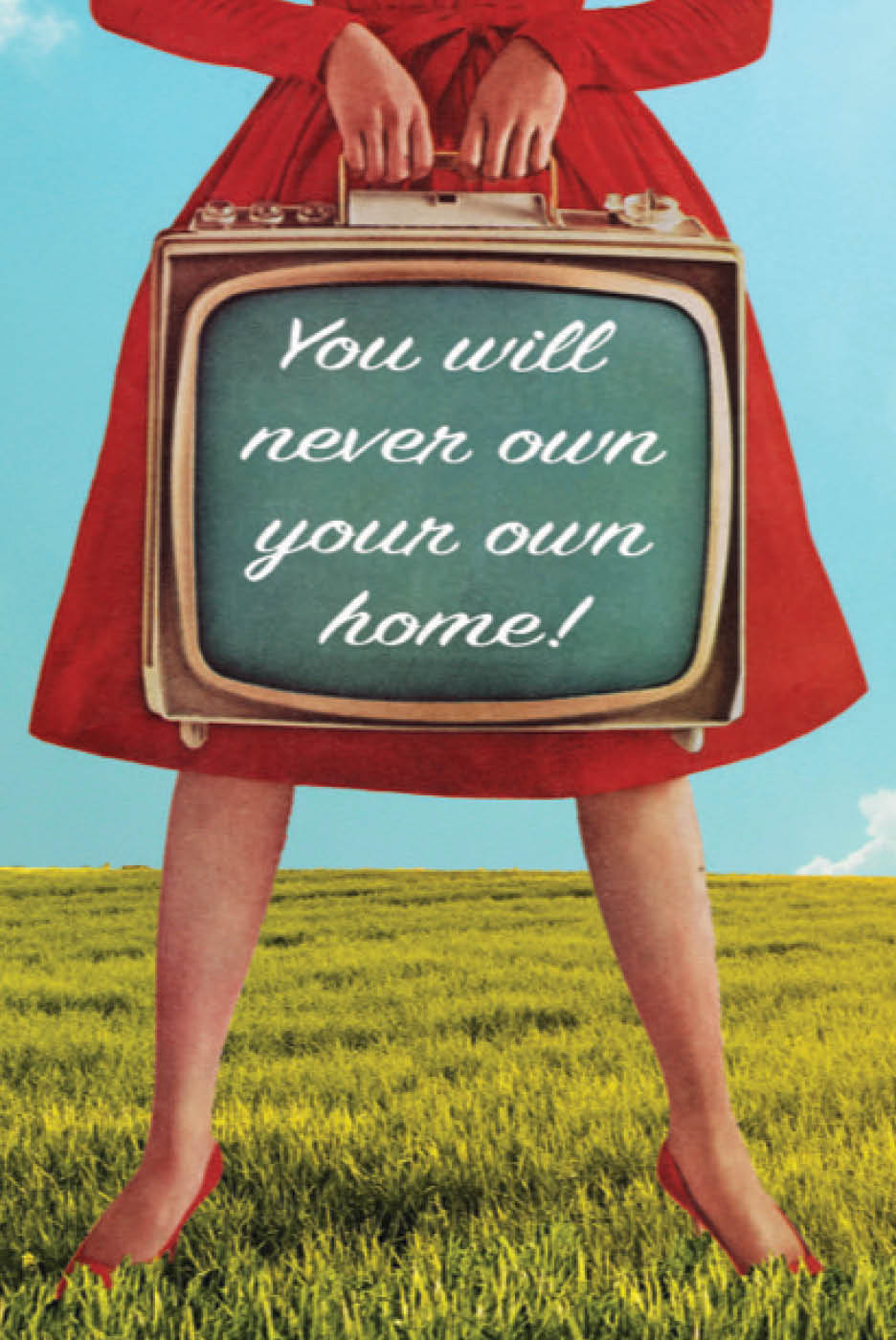

If you’re a millennial renter without access to the Bank of Mum and Dad, chances are you’re feeling more than a little depressed about the prospect of buying a house. Every week brings a new story about rising house prices (up 4.9 per cent since February!) or rising rents, or the near-impossibility of ever saving enough money to satisfy the banks’ increasingly stringent lending requirements.

In fact, more than 70 per cent of millennials say they believe they’ll never be able to own a home.

But if they can’t own homes like those of their parents’, what will they do instead? There are, after all, only so many smashed avocados one can eat. So we asked a handful of millennial women about their financial planning for a future that might not ever feature a white-picket-fenced family home.

“I live in a tiny house”

“I live about 20 kilometres west of Nowra on the Shoalhaven River in a place called Barringella,” says Molly Lasker, 27, a full-time research student. “My partner Al and I live in a tiny house on my parent’s property, where I grew up.

“In 2019 we quit our jobs to go travelling; a week after we got back, the country went into lockdown and we moved into the house. Our priorities shifted during this time. We became more insular and enjoyed a slower lifestyle. Cities are often heralded as the bastions of creativity, but I’ve found living in a regional area to be incredibly inspiring. Lockdown showed us that living down here might be a better idea long-term.

“We definitely couldn’t afford to buy a house but living the way we do—in a tiny house in a regional area—offers us so much freedom. We go camping most weekends, we don’t have to work excessively, and we’ve been able to pursue creative careers.

“Living in a tiny home also helps to put things into perspective, which feels liberating. You’re not stuck in these cycles of endless consumption. It helps you to acknowledge your priorities. For us, that’s being responsible for what we accumulate. We live quite closely with nature. We have a composting toilet so we literally have to deal with our own shit.

“While we don’t have to pay for electricity because we have solar panels and a water tank, we pay for it with our own time and resources. That’s been really interesting. Especially with the climate crisis looming over us all.

“I feel spiritually richer for living this way and the freedom it has afforded my lifestyle.”

“I bought an investment property in another state”

Hannah, 35, was renting in Sydney’s desirable inner west for the best part of a decade. “I assumed I would be renting forever,” she says. “And I thought maybe that was OK. I liked the idea of having the flexibility to travel and spend money on other things. But about three years ago, I realised I did want to own my own home. I sat down with a mortgage broker – and that’s when reality hit.

“Then a friend who was working in finance asked if I’d considered an investment property.

“Initially I thought it would be risky and a lot of effort, but he knew about a development in a growing area north of Brisbane where I could buy for $340K. I already had the deposit for that. It isn’t making me any money but its value is slowly growing.

“Now, I’m just about to buy my own home in Sydney with my partner. I managed to keep the investment property so we could use the equity.

“It helped me break down the mental barrier to property ownership. It was like a trial run.”

“We might travel or invest in a business”

“The fact that we may never own our own home hit us this year, when we were finally ready to start looking,” says Zena Chamas, 35, a journalist from Melbourne.

“We are both part-time workers (after having a baby, we decided to share the care), and because of that, we’ve been told by banks we can only borrow $700,000, which is nowhere near what we need to buy a house in the area we live in (an eastern suburb about half an hour away from Melbourne’s CBD).

“We were shocked: we’d always been financially savvy, putting aside money every week and budgeting for what we needed, and we’ve saved a sizeable deposit. Admittedly, having a baby and transitioning to working part-time, along with reduced hours during the pandemic, did set us back a little, but we’ve since got back on our feet. Clearly, though, our life savings are not enough for the banks.

“Looking back, we probably waited a little too long to buy, but we had other expenses over the years. My husband is from the US, so first we had to apply for and pay for a spousal visa, which cost about $10,000.

“We also had a $20,000 wedding and a honeymoon in Europe. That said, we managed to keep doing all these nice things while still saving. We’ve also always rented near the city (before our baby), so I can’t say we haven’t led a comfortable life.

“We’ll probably try to keep adding to the deposit, but eventually we’d like to travel, so if we don’t end up buying a home, we’ll take our little bub around the world or invest in a business – my husband has always wanted to open a restaurant.”

“I’m investing in super instead”

Alex Andrews, 32, co-founder of Verve Super, is renting in Sydney and – perhaps unsurprisingly – is contributing more to her superannuation. “Currently I have no desire to lock myself into a mortgage,” she says. “I think a lot of people don’t take into account the lack of flexibility it enforces. You can’t change your career path, you can’t take extended time off to be with your family if needed, and it comes with huge expenses like homeowners insurance, council fees and strata.

“As a renter, I know exactly what my costs are. When I’m budgeting I can be very clear about what the next year looks like and this allows me to be more aggressive in my saving and investing.

“I also think it allows you to look at how you’re building your financial future in other areas, rather than just this one big investment. The value of investing in superannuation above your employer contributions appeals to me for two reasons: it’s a really effective way of navigating different tax structures. You can bring your take home pay down slightly and not see a huge reduction on a day to day basis. And then there’s the First Home Super Saver Scheme (FHSSS) which means if I ever do want to buy a house, I can withdraw a certain amount of my super to purchase my first home.

“That all being said, when there’s instability in the housing market, that flows through to renters, too. I’ve experienced disruption twice in 18 months. First with a 30 per cent rental increase, which forced us into a new rental. And now the owners of that rental have decided to sell 12 weeks after we moved in. This has meant I’m going to inspections with a newborn baby.

“I have never wanted to own a home more than in the last 12 months but only because I want the stability of knowing what my living arrangements are.”

“I want the flexibility to travel”

“We recently returned to Australia after living in Bali, where the cost of living is almost on par with here,” says Nichola Spain, 32, from the Sunshine Coast, who runs Montville Estate Airbnb from her parents’ property. “We decided to cut our losses and return home, where we plan to rent for the next year or so before hopefully moving to Europe for a period of time.

“Having the flexibility to live in different parts of the world with my family and to expose my son to a different lifestyle and cultures is our main priority.

“For us, owning property has never been the first and foremost thing we desire to do. We just don’t see the benefit in it financially, and it makes a lot more sense for us to either rent or float around.

“Seven years ago, I had a stable job in journalism, which made my family very happy. But then I flipped that trajectory on its head by moving interstate, becoming a yoga teacher and opening up my first business, a holistic gym, with my partner. It was the most liberating decision I have ever made.

“I don’t foresee home ownership in the future unless it is something I can also turn into a business. I would never want to invest such a significant amount of money into something I couldn’t monetise. The idea of paying off a mortgage where you’re not getting any real return doesn’t make much sense to me.

“I don’t worry about my financial future. I’m not the one a million dollars in debt. Not purchasing a house has provided us with a level of freedom we otherwise wouldn’t have. It’s definitely not a dream lost, it feels more like another opportunity realised.”

Main picture collage by Millie Bartlett

No Comments